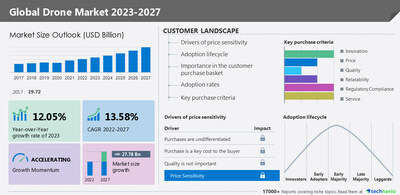

Drone market size is estimated to grow by USD 27.78 billion between 2022 and 2027, Historic market size was valued at USD 19.72 billion in 2017- Technavio

NEW YORK, Feb. 24, 2023 /PRNewswire/ — According to Technavio, the global drone market size is estimated to grow by USD 27.78 billion from 2022 to 2027. The market is estimated to grow at a CAGR of 13.58% during the forecast period. Moreover, the growth momentum will accelerate. APAC will account for 38% of the market’s growth. The report provides a comprehensive analysis of growth opportunities at regional levels, new product launches, the latest trends, and the post-pandemic recovery of the global market.

For more insights on the historic (2017 to 2021) and forecast market size (2022 to 2027) – Request a sample report

Why Buy?

- Add credibility to strategy

- Analyzes competitor’s offerings

- Get a holistic view of the market

Grow your profit margin with Technavio – buy now

E-scooter market- Segmentation Assessment

Segment Overview

Technavio has segmented the market based on application (industrial, terrestrial imagery and mapping, precision agriculture, inspection and monitoring, and others), and type (rotary blade, fixed wing, and hybrid).

- The industrial segment will grow at the highest rate during the forecast period. The real-time airborne inspection makes it possible to quickly assess construction sites or find errors. Drone-monitored construction sites saw a 91% reduction in potentially dangerous mishaps. Since 2016, the drone manufacturer 3D Robotics has received repeated investments from Autodesk, a market leader in software for architecture and construction, through its Forge Funds. Forge Platform from Autodesk is being used by 3D Robotics to offer a UAV-to-cloud solution. Their drones may gather site information that is then analyzed using the Autodesk software. The drone serves as a little replacement cell tower that can be used to distribute the load on static towers at catastrophe scenes or during major events. Therefore, such factors are expected to drive demand for drones in industrial applications during the forecast period.

Geography Overview

By geography, the global drone market is segmented into APAC, North America, Europe, Middle East and Africa, and South America. The report provides actionable insights and estimates the contribution of all regions to the growth of the global e-scooter market.

- APAC is estimated to account for 38% of the growth of the global market during the forecast period. APAC accounted for the dominant share of the global market in 2022. China is the main revenue contributor to the market in the region. The country is witnessing the swiftly growing adoption of drones in the agriculture, construction, defense, and mining industries. Additionally, Japan, India, and South Korea are witnessing the rapid adoption of drones. In June 2019, the Government of Japan adopted a draft bill to create advanced cities called Supercity. The government is aiming at deploying product deliveries by drones, autonomous driving, novel services, and cashless payment services in these cities using sophisticated technologies, such as AI and big data. Furthermore, India has a large consumer base with high technology adoption potential. Therefore, several technology companies and service providers are focusing on deploying drone-based services across the country, which is likely to generate attractive growth opportunities for manufacturers and, subsequently, for drone flight management system suppliers. Hence, such factors are likely to propel the regional market during the forecast period.

Get a glance of the market contribution of various segments including country and

region wise – Download a Sample Report

E-scooter market– Market Dynamics

Key factor driving market growth

- The advancements in sensors and the emergence of low-cost drones are notably driving the market growth.

- Drones are majorly equipped with GPS, inertial, image, and ultrasound-based range sensors.

- With improvements in functionalities and features, drones are increasingly equipped with thermal, hyperspectral, and multispectral sensors.

- As the price of sensors continues to fall, more drones will emerge during the forecast period.

- Furthermore, drones will increasingly witness demand from beginners, who are yet to get acquainted with the technology and features of drones.

- Advantages such as no need for registration (as per the US FAA), 720p HD cameras with satisfactory stability, and compatibility with virtual reality (VR) headsets are major factors that will increase their adoption rate among consumers around the globe during the forecast period.

Leading trends influencing the market

- New developments and launches of commercial drones are major trends in the market.

- Drones have revolutionized the commercial domain, given their easy deployment, low associated maintenance costs, relatively high mobility, and hovering ability.

- Commercial drone manufacturers have launched several product lines to attract buyers from different segments. For instance, Chinese commercial drone manufacturer DJI has introduced several models of drone platforms and solutions to its product portfolio to cater to the needs of hobbyists, professional filmmakers, and industry enterprise users.

- Therefore, it is estimated that the growing use of drones drives developments in the commercial sector of the global market. Hence, such factors will boost the global market growth during the forecast period.

Major challenges hindering the market growth

- The restrictive laws and regulations governing UAV use are major challenges impeding the market growth.

- Criminals and terrorists can hack drones and use them for criminal activities.

- The ease of regulations on drone applications is likely to provide an advantage for criminals and terrorists to use drones for carrying out terrorism and criminal activities.

- Therefore, to avoid such serious situations, governments in various countries have banned the use of UAVs around highly sensitive areas.

- Additionally, a flight management system is responsible for drone operations, and the flight management system of commercial drones can be hacked easily.

- Therefore, such factors can deter the wide adoption of commercial drones, which may hinder the growth of the global market during the forecast period.

For more details on drivers, trends, and challenges – Find some insights from a sample

report!

What are the key data covered in this drone market report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the drone market between 2023 and 2027

- Precise estimation of the size of the drone market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the e-scooter industry across APAC, North America, Europe, Middle East and Africa, and South America

- A thorough analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of drone market vendors

Gain instant access to 17,000+ market research reports.

Technavio’s SUBSCRIPTION platform

Related Reports:

- The drone payload market is estimated to grow at a CAGR of 13.82% between 2022 and 2027. The size of the market is forecasted to increase by USD 8,795.43 million. This report extensively covers market segmentation by type (sensors, weaponry, radar, and others), end-user (defense and commercial), and geography (North America, Europe, APAC, Middle East and Africa, and South America).

- The drone package delivery market is expected to increase by USD 13.54 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 42.75%. This report extensively covers market segmentation by type (hybrid wing, fixed-wing, and rotary wing), and geography (North America, Europe, APAC, South America, and Middle East and Africa)

Drone Market Scope | |

Report Coverage | Details |

Page number | 172 |

Base year | 2022 |

Historic period | 2017-2021 |

Forecast period | 2023-2027 |

Growth momentum & CAGR | Accelerate at a CAGR of 13.58% |

Market growth 2023-2027 | USD 27.78 billion |

Market structure | Fragmented |

YoY growth 2022-2023 (%) | 12.05 |

Regional analysis | APAC, North America, Europe, Middle East and Africa, and South America |

Performing market contribution | APAC at 38% |

Key countries | US, China, Japan, Germany, and UK |

Competitive landscape | Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

Key companies profiled | AeroVironment Inc., Autel Robotics Co. Ltd., DELAIR SAS, Drone Delivery Canada Corp., DroneDeploy Inc., EHang Holdings Ltd., Intel Corp., Kespry Inc., Kitty Hawk Corp., Leptron Unmanned Aircraft Systems Inc., Parrot Drones SAS, Pix4D SA, PrecisionHawk Inc., Skydio Inc., SZ DJI Technology Co. Ltd., Teledyne Technologies Inc., Terra Motors Corp., The Boeing Co., Trimble Inc., and Yuneec International Co. Ltd. |

Market dynamics | Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Browse for Technavio Industrials Market reports

Table of Contents

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Application

- Exhibit 06: Executive Summary – Chart on Market Segmentation by Type

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.3 Market size 2022

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global – Market size and forecast 2022-2027 ($ billion)

- Exhibit 15: Data Table on Global – Market size and forecast 2022-2027 ($ billion)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global drone market 2017 – 2021

- Exhibit 18: Historic Market Size – Data Table on Global drone market 2017 – 2021 ($ billion)

- 4.2 Application Segment Analysis 2017 – 2021

- Exhibit 19: Historic Market Size – Application Segment 2017 – 2021 ($ billion)

- 4.3 Type Segment Analysis 2017 – 2021

- Exhibit 20: Historic Market Size – Type Segment 2017 – 2021 ($ billion)

- 4.4 Geography Segment Analysis 2017 – 2021

- Exhibit 21: Historic Market Size – Geography Segment 2017 – 2021 ($ billion)

- 4.5 Country Segment Analysis 2017 – 2021

- Exhibit 22: Historic Market Size – Country Segment 2017 – 2021 ($ billion)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis – Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition – Five forces 2022 and 2027

6 Market Segmentation by Application

- 6.1 Market segments

- Exhibit 30: Chart on Application – Market share 2022-2027 (%)

- Exhibit 31: Data Table on Application – Market share 2022-2027 (%)

- 6.2 Comparison by Application

- Exhibit 32: Chart on Comparison by Application

- Exhibit 33: Data Table on Comparison by Application

- 6.3 Industrial – Market size and forecast 2022-2027

- Exhibit 34: Chart on Industrial – Market size and forecast 2022-2027 ($ billion)

- Exhibit 35: Data Table on Industrial – Market size and forecast 2022-2027 ($ billion)

- Exhibit 36: Chart on Industrial – Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on Industrial – Year-over-year growth 2022-2027 (%)

- 6.4 Terrestrial imagery and mapping – Market size and forecast 2022-2027

- Exhibit 38: Chart on Terrestrial imagery and mapping – Market size and forecast 2022-2027 ($ billion)

- Exhibit 39: Data Table on Terrestrial imagery and mapping – Market size and forecast 2022-2027 ($ billion)

- Exhibit 40: Chart on Terrestrial imagery and mapping – Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Terrestrial imagery and mapping – Year-over-year growth 2022-2027 (%)

- 6.5 Precision agriculture – Market size and forecast 2022-2027

- Exhibit 42: Chart on Precision agriculture – Market size and forecast 2022-2027 ($ billion)

- Exhibit 43: Data Table on Precision agriculture – Market size and forecast 2022-2027 ($ billion)

- Exhibit 44: Chart on Precision agriculture – Year-over-year growth 2022-2027 (%)

- Exhibit 45: Data Table on Precision agriculture – Year-over-year growth 2022-2027 (%)

- 6.6 Inspection and monitoring – Market size and forecast 2022-2027

- Exhibit 46: Chart on Inspection and monitoring – Market size and forecast 2022-2027 ($ billion)

- Exhibit 47: Data Table on Inspection and monitoring – Market size and forecast 2022-2027 ($ billion)

- Exhibit 48: Chart on Inspection and monitoring – Year-over-year growth 2022-2027 (%)

- Exhibit 49: Data Table on Inspection and monitoring – Year-over-year growth 2022-2027 (%)

- 6.7 Others – Market size and forecast 2022-2027

- Exhibit 50: Chart on Others – Market size and forecast 2022-2027 ($ billion)

- Exhibit 51: Data Table on Others – Market size and forecast 2022-2027 ($ billion)

- Exhibit 52: Chart on Others – Year-over-year growth 2022-2027 (%)

- Exhibit 53: Data Table on Others – Year-over-year growth 2022-2027 (%)

- 6.8 Market opportunity by Application

- Exhibit 54: Market opportunity by Application ($ billion)

7 Market Segmentation by Type

- 7.1 Market segments

- Exhibit 55: Chart on Type – Market share 2022-2027 (%)

- Exhibit 56: Data Table on Type – Market share 2022-2027 (%)

- 7.2 Comparison by Type

- Exhibit 57: Chart on Comparison by Type

- Exhibit 58: Data Table on Comparison by Type

- 7.3 Rotary blade – Market size and forecast 2022-2027

- Exhibit 59: Chart on Rotary blade – Market size and forecast 2022-2027 ($ billion)

- Exhibit 60: Data Table on Rotary blade – Market size and forecast 2022-2027 ($ billion)

- Exhibit 61: Chart on Rotary blade – Year-over-year growth 2022-2027 (%)

- Exhibit 62: Data Table on Rotary blade – Year-over-year growth 2022-2027 (%)

- 7.4 Fixed wing – Market size and forecast 2022-2027

- Exhibit 63: Chart on Fixed wing – Market size and forecast 2022-2027 ($ billion)

- Exhibit 64: Data Table on Fixed wing – Market size and forecast 2022-2027 ($ billion)

- Exhibit 65: Chart on Fixed wing – Year-over-year growth 2022-2027 (%)

- Exhibit 66: Data Table on Fixed wing – Year-over-year growth 2022-2027 (%)

- 7.5 Hybrid – Market size and forecast 2022-2027

- Exhibit 67: Chart on Hybrid – Market size and forecast 2022-2027 ($ billion)

- Exhibit 68: Data Table on Hybrid – Market size and forecast 2022-2027 ($ billion)

- Exhibit 69: Chart on Hybrid – Year-over-year growth 2022-2027 (%)

- Exhibit 70: Data Table on Hybrid – Year-over-year growth 2022-2027 (%)

- 7.6 Market opportunity by Type

- Exhibit 71: Market opportunity by Type ($ billion)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 72: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 73: Chart on Market share by geography 2022-2027 (%)

- Exhibit 74: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 75: Chart on Geographic comparison

- Exhibit 76: Data Table on Geographic comparison

- 9.3 APAC – Market size and forecast 2022-2027

- Exhibit 77: Chart on APAC – Market size and forecast 2022-2027 ($ billion)

- Exhibit 78: Data Table on APAC – Market size and forecast 2022-2027 ($ billion)

- Exhibit 79: Chart on APAC – Year-over-year growth 2022-2027 (%)

- Exhibit 80: Data Table on APAC – Year-over-year growth 2022-2027 (%)

- 9.4 North America – Market size and forecast 2022-2027

- Exhibit 81: Chart on North America – Market size and forecast 2022-2027 ($ billion)

- Exhibit 82: Data Table on North America – Market size and forecast 2022-2027 ($ billion)

- Exhibit 83: Chart on North America – Year-over-year growth 2022-2027 (%)

- Exhibit 84: Data Table on North America – Year-over-year growth 2022-2027 (%)

- 9.5 Europe – Market size and forecast 2022-2027

- Exhibit 85: Chart on Europe – Market size and forecast 2022-2027 ($ billion)

- Exhibit 86: Data Table on Europe – Market size and forecast 2022-2027 ($ billion)

- Exhibit 87: Chart on Europe – Year-over-year growth 2022-2027 (%)

- Exhibit 88: Data Table on Europe – Year-over-year growth 2022-2027 (%)

- 9.6 Middle East and Africa – Market size and forecast 2022-2027

- Exhibit 89: Chart on Middle East and Africa – Market size and forecast 2022-2027 ($ billion)

- Exhibit 90: Data Table on Middle East and Africa – Market size and forecast 2022-2027 ($ billion)

- Exhibit 91: Chart on Middle East and Africa – Year-over-year growth 2022-2027 (%)

- Exhibit 92: Data Table on Middle East and Africa – Year-over-year growth 2022-2027 (%)

- 9.7 South America – Market size and forecast 2022-2027

- Exhibit 93: Chart on South America – Market size and forecast 2022-2027 ($ billion)

- Exhibit 94: Data Table on South America – Market size and forecast 2022-2027 ($ billion)

- Exhibit 95: Chart on South America – Year-over-year growth 2022-2027 (%)

- Exhibit 96: Data Table on South America – Year-over-year growth 2022-2027 (%)

- 9.8 China – Market size and forecast 2022-2027

- Exhibit 97: Chart on China – Market size and forecast 2022-2027 ($ billion)

- Exhibit 98: Data Table on China – Market size and forecast 2022-2027 ($ billion)

- Exhibit 99: Chart on China – Year-over-year growth 2022-2027 (%)

- Exhibit 100: Data Table on China – Year-over-year growth 2022-2027 (%)

- 9.9 US – Market size and forecast 2022-2027

- Exhibit 101: Chart on US – Market size and forecast 2022-2027 ($ billion)

- Exhibit 102: Data Table on US – Market size and forecast 2022-2027 ($ billion)

- Exhibit 103: Chart on US – Year-over-year growth 2022-2027 (%)

- Exhibit 104: Data Table on US – Year-over-year growth 2022-2027 (%)

- 9.10 Germany – Market size and forecast 2022-2027

- Exhibit 105: Chart on Germany – Market size and forecast 2022-2027 ($ billion)

- Exhibit 106: Data Table on Germany – Market size and forecast 2022-2027 ($ billion)

- Exhibit 107: Chart on Germany – Year-over-year growth 2022-2027 (%)

- Exhibit 108: Data Table on Germany – Year-over-year growth 2022-2027 (%)

- 9.11 Japan – Market size and forecast 2022-2027

- Exhibit 109: Chart on Japan – Market size and forecast 2022-2027 ($ billion)

- Exhibit 110: Data Table on Japan – Market size and forecast 2022-2027 ($ billion)

- Exhibit 111: Chart on Japan – Year-over-year growth 2022-2027 (%)

- Exhibit 112: Data Table on Japan – Year-over-year growth 2022-2027 (%)

- 9.12 UK – Market size and forecast 2022-2027

- Exhibit 113: Chart on UK – Market size and forecast 2022-2027 ($ billion)

- Exhibit 114: Data Table on UK – Market size and forecast 2022-2027 ($ billion)

- Exhibit 115: Chart on UK – Year-over-year growth 2022-2027 (%)

- Exhibit 116: Data Table on UK – Year-over-year growth 2022-2027 (%)

- 9.13 Market opportunity by geography

- Exhibit 117: Market opportunity by geography ($ billion)

10 Drivers, Challenges, and Trends

- 10.1 Market drivers

- 10.2 Market challenges

- 10.3 Impact of drivers and challenges

- Exhibit 118: Impact of drivers and challenges in 2022 and 2027

- 10.4 Market trends

11 Vendor Landscape

- 11.1 Overview

- 11.2 Vendor landscape

- Exhibit 119: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 120: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 121: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 122: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 123: Matrix on vendor position and classification

- 12.3 AeroVironment Inc.

- Exhibit 124: AeroVironment Inc. – Overview

- Exhibit 125: AeroVironment Inc. – Business segments

- Exhibit 126: AeroVironment Inc. – Key news

- Exhibit 127: AeroVironment Inc. – Key offerings

- Exhibit 128: AeroVironment Inc. – Segment focus

- 12.4 Autel Robotics Co. Ltd.

- Exhibit 129: Autel Robotics Co. Ltd. – Overview

- Exhibit 130: Autel Robotics Co. Ltd. – Product / Service

- Exhibit 131: Autel Robotics Co. Ltd. – Key offerings

- 12.5 DELAIR SAS

- Exhibit 132: DELAIR SAS – Overview

- Exhibit 133: DELAIR SAS – Product / Service

- Exhibit 134: DELAIR SAS – Key offerings

- 12.6 Drone Delivery Canada Corp.

- Exhibit 135: Drone Delivery Canada Corp. – Overview

- Exhibit 136: Drone Delivery Canada Corp. – Product / Service

- Exhibit 137: Drone Delivery Canada Corp. – Key offerings

- 12.7 DroneDeploy Inc.

- Exhibit 138: DroneDeploy Inc. – Overview

- Exhibit 139: DroneDeploy Inc. – Product / Service

- Exhibit 140: DroneDeploy Inc. – Key offerings

- 12.8 Intel Corp.

- Exhibit 141: Intel Corp. – Overview

- Exhibit 142: Intel Corp. – Business segments

- Exhibit 143: Intel Corp. – Key news

- Exhibit 144: Intel Corp. – Key offerings

- Exhibit 145: Intel Corp. – Segment focus

- 12.9 Kespry Inc.

- Exhibit 146: Kespry Inc. – Overview

- Exhibit 147: Kespry Inc. – Product / Service

- Exhibit 148: Kespry Inc. – Key offerings

- 12.10 Kitty Hawk Corp.

- Exhibit 149: Kitty Hawk Corp. – Overview

- Exhibit 150: Kitty Hawk Corp. – Product / Service

- Exhibit 151: Kitty Hawk Corp. – Key offerings

- 12.11 Leptron Unmanned Aircraft Systems Inc.

- Exhibit 152: Leptron Unmanned Aircraft Systems Inc. – Overview

- Exhibit 153: Leptron Unmanned Aircraft Systems Inc. – Product / Service

- Exhibit 154: Leptron Unmanned Aircraft Systems Inc. – Key offerings

- 12.12 Parrot Drones SAS

- Exhibit 155: Parrot Drones SAS – Overview

- Exhibit 156: Parrot Drones SAS – Product / Service

- Exhibit 157: Parrot Drones SAS – Key offerings

- 12.13 Pix4D SA

- Exhibit 158: Pix4D SA – Overview

- Exhibit 159: Pix4D SA – Product / Service

- Exhibit 160: Pix4D SA – Key offerings

- 12.14 PrecisionHawk Inc.

- Exhibit 161: PrecisionHawk Inc. – Overview

- Exhibit 162: PrecisionHawk Inc. – Product / Service

- Exhibit 163: PrecisionHawk Inc. – Key offerings

- 12.15 SZ DJI Technology Co. Ltd.

- Exhibit 164: SZ DJI Technology Co. Ltd. – Overview

- Exhibit 165: SZ DJI Technology Co. Ltd. – Product / Service

- Exhibit 166: SZ DJI Technology Co. Ltd. – Key offerings

- 12.16 The Boeing Co.

- Exhibit 167: The Boeing Co. – Overview

- Exhibit 168: The Boeing Co. – Business segments

- Exhibit 169: The Boeing Co. – Key news

- Exhibit 170: The Boeing Co. – Key offerings

- Exhibit 171: The Boeing Co. – Segment focus

- 12.17 Yuneec International Co. Ltd.

- Exhibit 172: Yuneec International Co. Ltd. – Overview

- Exhibit 173: Yuneec International Co. Ltd. – Product / Service

- Exhibit 174: Yuneec International Co. Ltd. – Key offerings

13 Appendix

- 13.1 Scope of the report

- 13.2 Inclusions and exclusions checklist

- Exhibit 175: Inclusions checklist

- Exhibit 176: Exclusions checklist

- 13.3 Currency conversion rates for US$

- Exhibit 177: Currency conversion rates for US$

- 13.4 Research methodology

- Exhibit 178: Research methodology

- Exhibit 179: Validation techniques employed for market sizing

- Exhibit 180: Information sources

- 13.5 List of abbreviations

- Exhibit 181: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provide actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/drone-market-size-is-estimated-to-grow-by-usd-27-78-billion-between-2022-and-2027–historic-market-size-was-valued-at-usd-19-72-billion-in-2017–technavio-301754314.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/drone-market-size-is-estimated-to-grow-by-usd-27-78-billion-between-2022-and-2027–historic-market-size-was-valued-at-usd-19-72-billion-in-2017–technavio-301754314.html

SOURCE Technavio

Private Internet Access gives you unparalleled access to thousands

of next-gen servers in over 83 countries and each US state. Your

VPN experience will always be fast, smooth, and reliable.

Private Internet Access gives you unparalleled access to thousands

of next-gen servers in over 83 countries and each US state. Your

VPN experience will always be fast, smooth, and reliable.